This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

What is Financial Planning?

Helping You Achieve Your Life Goals

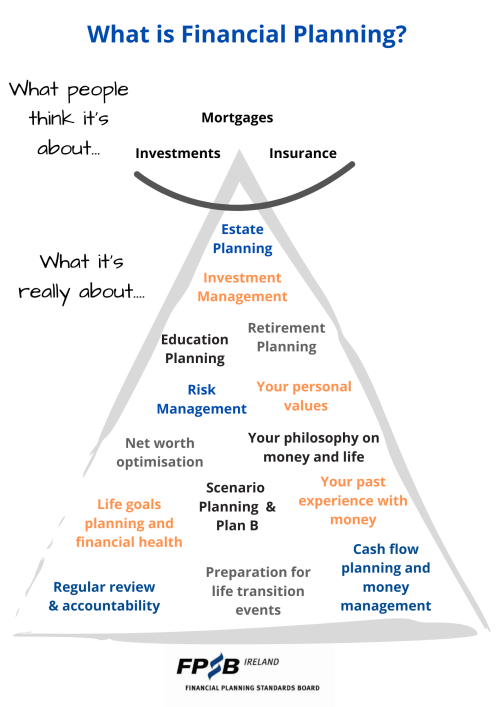

Financial Planning is a process of setting financial goals and creating a strategy to achieve them. It involves assessing your current financial situation, identifying your short-term and long-term goals, and developing a plan to help you achieve those goals.

The process also includes monitoring your progress and making adjustments as needed. Whether you would like to save money to buy a home, start a family, fund education or retire comfortably, financial planning can help you achieve financial wellbeing.

Financial Planning can cover a wide range of topics, including budgeting, saving and investing, managing debt, planning for retirement, and protecting against financial risks. By understanding your current financial situation and your short- and long-term objectives, a CERTIFIED FINANCIAL PLANNER professional can work with you to create a financial plan that provides a road map to help you achieve your life goals.

Many people worry about having enough money put away for a rainy day, what would happen if they were unable to work, how their family might manage if something happened to them or how they will fund their retirement.

The good news is that those who get professional financial advice are more likely to feel financially resilient. Overall, financial planning is a comprehensive and holistic approach to managing your money, and it can help you feel more in control of your finances and better prepared for the future.