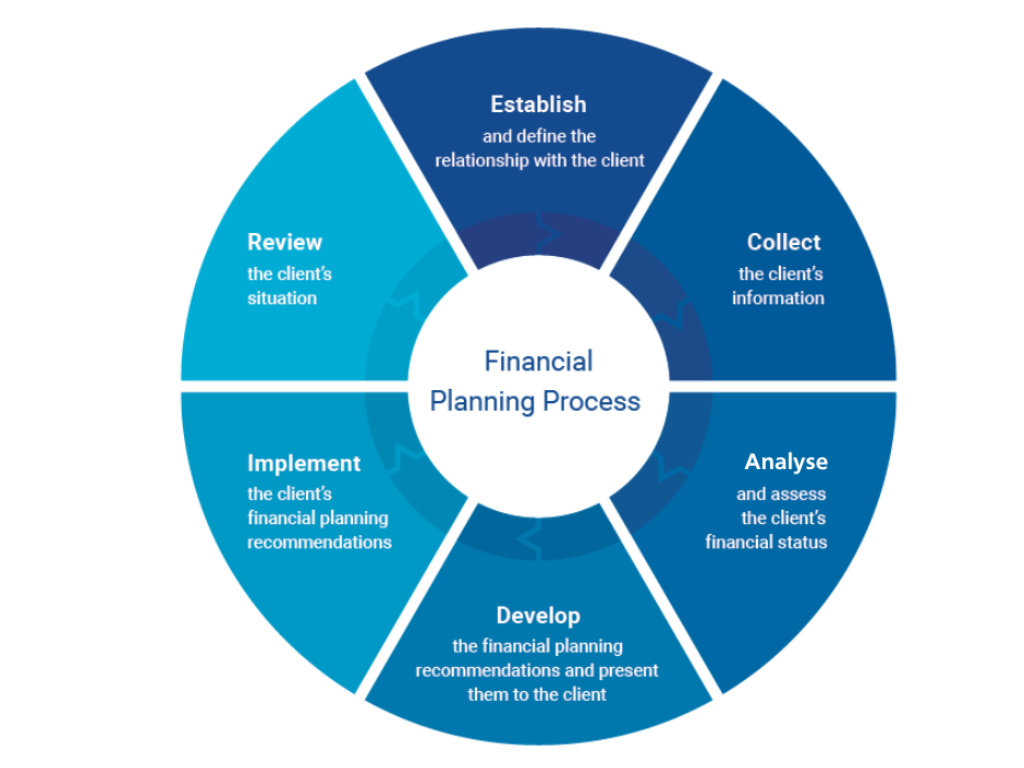

FPSB's 6-Step Financial Planning Process

Every CERTIFIED FINANCIAL PLANNER™ professional follows FPSB’s recognised six step process, designed to bring structure, clarity, and confidence.

Find out more about what each step entails below.

Step 1

Establish and Define the Client Planner Relationship

The planner outlines the scope of services, clarifies roles and responsibilities, and agrees how decisions will be made to ensure mutual understanding from the outset.

Step 2

Gather Client Data, Including Goals

The planner develops a comprehensive view of your financial position, identifies your goals and timelines, and collects relevant details to support accurate and tailored advice.

Step 3

Analyse and Evaluate Financial Status

The information gathered is assessed to determine what is required to achieve your goals and where opportunities for improvement exist

Step 4

Develop and Present Financial Planning Recommendations

Personalised recommendations are created and explained clearly to support informed decision-making. Feedback is incorporated to ensure the plan reflects your objectives and preferences.

Step 5

Implement the Financial Planning Recommendations

Once agreed, the plan is executed. The planner may coordinate the implementation directly or work alongside other professionals such as accountants, solicitors, or investment advisers.

Step 6

Monitor and Review

Progress is reviewed at agreed intervals to ensure the plan remains effective and aligned with evolving goals or changing circumstances.

Your Goals

This process is designed to make financial decisions simpler, clearer, and aligned with the life you want to build.